What counts as marketing expenditure? Historically, marketing expenditure has tended to escape rigorous performance appraisal for a numbe...

What counts as marketing expenditure?

Historically, marketing expenditure has tended to escape rigorous performance appraisal for a number of reasons. Firstly, there has been real confusion as to the true scope and nature of marketing investments. Too often, marketing expenditure has been assumed to be only the budgets put together by the marketing function and, as such, a (major) cost to be controlled rather than a potential driver of value.Secondly, the causal relationship between expenditure and results has been regarded as too difficult to pin down to any useful level of precision. Because of the demands of increasingly discerning customers and greater competition, marketing investments and marketing processes are under scrutiny as never before. From the process point of view, as a result of insights from management concepts such as the quality movement and re-engineering, marketing is now much more commonly seen as a cross-functional responsibility of the entire organization rather than just the marketing department’s problem.

Howard Morganis, past chairman of Procter & Gamble, said, ‘There is no such thing as a marketing skill by itself. For a company to be good at marketing, it must be good at everything else from R&D to manufacturing, from quality controls to financial controls.’ Hugh Davidson, in Even More Offensive Marketing (1997), comments, ‘Marketing is an approach to business rather than a specialist discipline. It is no more the exclusive responsibility of the marketing department than profitability is the sole charge of the finance department.’

But there is also a growing awareness that, because of this wider interpretation of marketing, nearly all budgets within the company could be regarded as marketing investments in one way or another. This is especially the case with IT budgets. The exponential increase in computing power has made it possible to track customer perceptions and behaviours on a far greater scale and with far greater precision than previously. When used correctly, these databases and analytical tools can shed a much greater light on what really happens inside the ‘black box’. However, the sums involved in acquiring such technologies are forcing even the most slapdash of companies to apply more rigorous appraisal techniques to their investments in this area.

This wider understanding of what ‘marketing’ is really all about has had a number of consequences. Firstly, the classic textbook treatment of strategic issues in marketing has finally caught up with reality. Topics such as market and customer segmentation, product and brand development, databases and customer service and support are now regularly discussed at board level, instead of being left to operational managers or obscure research specialists.

CEOs and MDs are increasingly accepting that they must take on the role of chief marketing officer if they want to create truly customer-led organizations and because of their ‘new’ mission-critical status, marketing investments are attracting the serious attention of finance professionals. As part of a wider revolution in thinking about what kind of corporate assets are important in today’s business environment, intangibles such as knowledge about customers and markets, or the power of brands, have assumed a new importance. The race is on to find robust methods of quantifying and evaluating such assets for the benefit of corporate managements and the wider investment community.

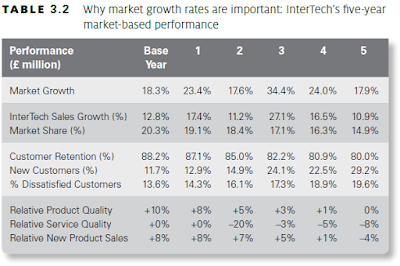

However, one of the major problems of marketing expenditure is that it takes time for the effects to manifest themselves in the market. This time lag often transcends the annual fiscal profit and loss account measurement. The reverse is true, of course, in that, without additional market-based data in the boardroom, directors are often flying blind. When the financials tell them there is a problem, they have already missed the optimal point for taking appropriate corrective action. This can be seen from the data in Table 3.1, from which it would appear that InterTech (a disguised name for confidentiality reasons) is doing extremely well. A quick glance at Table 3.2, however, shows that most market indicators are negative. It is obvious that, when market conditions are less benign, this company will not last long.

In terms of accountability, this raises the issue of the value of profit and loss accounts in the boardroom. There is often only one line for revenue and dozens of lines for costs. The result frequently is that most of the discussion revolves around variances related to cost ratios. The point here is that there is a case for a more detailed breakdown of revenue, and indeed there is a trend among some leading companies to appoint a ‘director of revenue generation’ in order to address this problem.

What does ‘value added’ really mean?

The term ‘value added’ has fast become the new mantra for the 21st-century business literature, and is often used quite loosely to indicate a business concept that is intended to exceed either customer or investor expectations, or both. However, from the point of view of this chapter, it is important to realize that the term has its origin in a number of different management ideas, and is used in very specific ways by different sets of authors. Most of the ideas come from the United States, and originated in business school and consultancy research.Value chain analysis

Firstly, there is Michael Porter’s well-known concept of value chain analysis. Porter’s concept of value added is an incremental one; he focuses on how successive activities change the value of goods and services as they pass through various stages of a value chain:Value chain analysis is used to identify potential sources of economic advantage. The analysis disaggregates a firm into its major activities in order to understand the behaviour of costs and the existing and potential sources of differentiation. It determines how the firm’s own value chain interacts with the value chains of suppliers, customers and competitors. Companies gain competitive advantage by performing some or all of these activities at lower cost or with greater differentiation than competitors. (Porter, 1985)

Shareholder value added (SVA)

Secondly, there is Alfred Rappaport’s equally well-known research on shareholder value added. Rappaport’s concept of value added focuses less on processes than Porter’s, and acts more as a final gateway in decision making, although it can be used at multiple levels within a firm. SVA is described as:The process of analysing how decisions affect the net present value of cash to shareholders. The analysis measures a company’s ability to earn more than its total cost of capital... Within business units, SVA measures the value the unit has created by analysing cash flows over time. At the corporate level, SVA provides a framework for evaluating options for improving shareholder value by determining the tradeoffs between reinvesting in existing businesses, investing in new businesses and returning cash to stockholders. (Rappaport, 1986, 1998)

There are a number of different ways of measuring shareholder value added, one of which, market value added (MVA), needs further explanation. Market value added is a measure which compares the total shareholder capital of a company (including retained earnings) with the current market value of the company (capitalization and debt). When one is deducted from the other, a positive result means value has been added, and a negative result means investors have lost out. Within the literature, there is much discussion of the merits of this measure as against those of another approach economic value added (EVA).

However, from the point of view of marketing value added, Walters and Halliday (1997) usefully sum up the discussion thus: ‘As aggregate measures and as relative performance indicators they have much to offer... [but] how can the manager responsible for developing and/or implementing growth objectives [use them] to identify and select from alternative [strategic] options?’

Market value added is one of a number of tools that analysts and the capital markets use to assess the value of a company. Marketing value added as a research topic focuses more directly on the processes of creating that value through effective marketing investments.

Customer value

A third way of looking at value added is the customer’s perception of value. Unfortunately, despite exhaustive research by academics and practitioners around the world, this elusive concept has proved almost impossible to pin down: ‘What constitutes [customer] value – even in a single product category – appears to be highly personal and idiosyncratic’, concludes Zeithaml (1988), for instance. Nevertheless, the individual customer’s perception of the extra value represented by different products and services cannot be easily dismissed: in the guise of measures such as customer satisfaction and customer loyalty, it is known to be the essence of brand success, and the whole basis of ‘relationship marketing’.Accounting value

Finally, there is the accountant’s definition of value added: ‘value added = sales revenue − purchases and services’. Effectively, this is a snapshot picture from the annual accounts of how the revenue from a sales period has been distributed, and how much is left over for reinvestment after meeting all costs, including shareholder dividends. Although this figure will say something about the past viability of a business, in itself it does not provide a guide to future prospects. One reason that the term ‘value added’ has come to be used rather carelessly is that all these concepts of value, although different, are not mutually exclusive. Porter’s value chain analysis is one of several extremely useful techniques for identifying potential new competitive market strategies. Rappaport’s SVA approach can be seen as a powerful tool that enables managers to cost out the long-term financial implications of pursuing one or other of the competitive strategies that have been identified. Customer perceptions are clearly a major driver (or destroyer) of annual audited accounting value in all companies, whatever strategy is pursued.However, most companies today accept that value added, as defined by their annual accounts, is really only a record of what they achieved in the past, and that financial targets in themselves are insufficient as business objectives. Many companies are now convinced that focusing on more intangible measures of value added such as brand equity, customer loyalty or customer satisfaction is the new route to achieving financial results.

Unfortunately, research has found that there is no neat, causal link between offering additional customer value and achieving value added on a balance sheet, ie good ratings from customers about perceived value do not necessarily lead to financial success. Nor do financially successful companies necessarily offer products and services that customers perceive as offering better value than competitors.

In order to explain the link that does exist between customer-orientated strategies and financial results, a far more rigorous approach to forecasting costs and revenues is required than is usual in marketing planning, coupled with a longer-term perspective on the payback period than is possible on an annual balance sheet. This cash-driven perspective is the basis of the SVA approach, and can be used in conjunction with any marketing-strategy formulation process.

However, despite the SVA approach’s apparent compatibility with existing planning systems, it is important to stress that adherents of the approach believe that, after all the calculations have been made about the impact of different strategic choices, the final decision about which strategy to pursue should be in favour of the one that generates the most value (cash) for shareholders. This point of view adds a further dimension to the strategic debate, and is by no means universally accepted: there is a vigorous and ongoing debate in the literature as to whether increasing shareholder value should be the ultimate objective of a corporation.

Despite these arguments, there is no denying that, during the last 15 years, SVA (or variants on the technique) has become the single most dominating corporate valuation perspective in developed Western economies. Its popularity tends to be limited to the boardroom and the stock exchanges, however. Several surveys (eg CSF Consulting in 2000 and KPMG in 1999) have found that less than 30 per cent of companies were pushing SVA-based management techniques down to an operational level, because of difficulties in translating cash targets into practical, day-to-day management objectives. This is a pity because, apart from its widespread use at corporate level, the SVA approach particularly merits extensive attention of researchers interested in putting a value on marketing, as it allows marketing investments (or indeed any investments) to be valued over a much longer period of time than the usual one-year budget cycle.

Although common sense might argue that developing strong product or service offerings and building up a loyal, satisfied customer base will usually require a series of one- to two-year investment plans in any business, nevertheless such is the universal distrust of marketing strategies and forecasts that it is common practice in most companies to write off marketing as a cost within each year’s budget. It is rare for such expenditure to be treated as an investment that will deliver results over a number of years, but research shows that companies that are able to do this create a lasting competitive edge.

Meanwhile, as stated earlier, research into marketing accountability continued apace at Cranfield; a three-level model having been developed and tested, and it is to this model that we now turn.

COMMENTS